Decentralized finance (“DeFi”), also referred to as open finance, is one of the areas in crypto that has received notable traction so far. At a high level, DeFi aims to create a lot of the existing financial systems we have today (e.g. borrowing, lending, derivatives) but in a manner that is typically automated and removes the middle man. Since DeFi is still in the early days, this post covers where I think it is headed and some of the interesting possibilities that can come about. Please see my list of resources if you are looking to learn the basics of DeFi.

Collateralization

One of the major complaints of DeFi is that the systems require overcollateralization in order to get a loan. Who would want to lock up so much capital? The argument is that it is a highly inefficient use of capital and many people do not have the extra funds in the first place. However, there is already $500M locked up in DeFi which shows there is demand for using this.

The purpose is typically for leverage especially during a bull market. For example, you lock up $200 worth of ETH to borrow $100 worth of DAI which you can then use to buy $100 more ETH. Another major reason is people don’t want to sell their crypto, which creates a taxable event, so they might prefer to take a loan out against their own collateral. Other reasons people use DeFi right now is it’s a lot more streamlined than traditional financial systems since the user doesn’t have to go through a complicated onboarding process with KYC, although I think that this aspect will eventually change for many projects. Additionally, some people excluded from traditional financial systems may also find DeFi to be beneficial, but I believe that use will be more prominent once the collateralization ratios decrease.

However, it is important to note that we are still in the early days of DeFi. The complaints about overcollateralization are a result of early systems that lack proper decentralized identity and reputation systems. Without these in place and a legal system for handling issues, the only way to make lenders comfortable is to require overcollateralization. Regardless of whether or not people believe this system should exist there is clear demand for it and the existing DeFi projects simply make it easier to access. Sometimes there is no good alternative for the borrower if they don’t want to sell their crypto and especially if they are excluded from traditional financial systems. The alternative for a lender would be to not earn interest on their crypto holdings, go through a centralized service which takes a large cut, or store as fiat in a bank account where the bank loans out the deposits and takes the vast majority of the interest rate earned. DeFi is a major step forward for both parties even though we still have a ways to go.

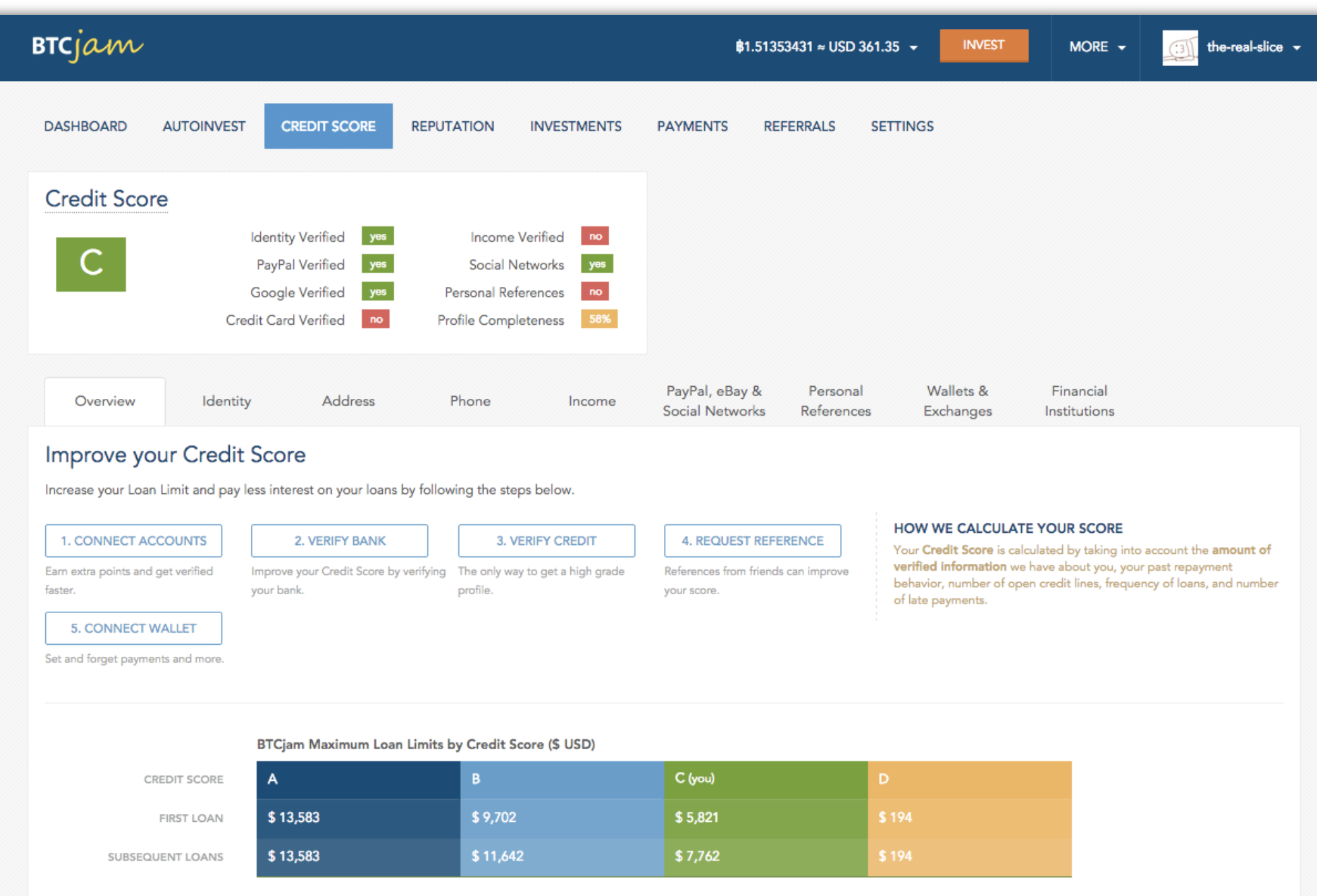

Once there are better identity and reputation systems that can plug into DeFi we will see the collateral requirements come down. Right now in the US there are multiple credit bureaus (e.g. Experian, TransUnion, Equifax) that other institutions like banks rely on to tell them an individual’s credit. Credit bureaus can put certain groups such as international and young people at a disadvantage. Peer to peer lending services like Lending Club address the problem of traditional financial services relying solely on FICO scores by offering additional data points like home ownership, income, and length of employment. Decentralized identity and reputation services could offer something similar including other attributes such as social media reputation, history of repayment of previous loans, vouching from other reputable users, etc. However, this isn’t just a magic bullet and will require a lot of trial and error of what data points to use and collateral to require. We saw early attempts at this in the crypto space with companies like BTCJam from 2012 to 2017 which let people lend out their bitcoin to borrowers, including those from emerging markets, with no collateral. BTCJam used their own proprietary credit score and reflected the interest rates accordingly. From my own experience using the platform several years ago, many of my loans defaulted even those that were rated high quality. Developers building DeFi systems should learn from past work like BTCJam to continue to improve.

Composability

One of the most unique aspects of DeFi is the composability. The protocols can plug into each other like lego pieces and create something completely new. There is even the idea of collateral being moved around to different systems referred to as superfluidity by Dan Elitzer. For example, you could take the collateral from one protocol and lend it out on another protocol. I have major concerns here because there is compounding smart contract risk and the entire point of overcollateralization in the first place is to ensure that in the event that the borrower can’t return the principal that the collateral is used. If the collateral is loaned out elsewhere and there is an issue, then that collateral is no longer useful. While I don’t feel too comfortable with this “superfluid” system, I do think it will be inevitable that people will start experimenting with this concept due to the inefficiency of large amounts of capital being locked up. I only hope that people can self-regulate and perhaps put in guardrails such as minimum collateral ratios.

There are also going to be many more platforms where users can deposit their funds which then gets lent out to the DeFi protocol with the highest interest rate (e.g. MetaMoneyMarket) so the user doesn’t have to manage it themselves. There would also be various settings that can be customized by the user. For example, you could set a max lend of X% of the funds to a single protocol to reduce smart contract risk, only lend to a specific list of protocols, return funds if interest rates fall below Y%, or give the option to switch from different stablecoins (e.g. USDC to DAI) depending on which rates are more favorable. A lot of these processes will also be abstracted away from the non-crypto native user. For example, instead of the user being prompted with a choice of which DeFi protocols to use they could just take a risk tolerance test and/or select their risk score similar to how Wealthfront presents it to their users.

Assets

I’m a big fan of bringing more tokenized versions of assets such as bitcoin into DeFi. In a bull market I believe there will be significant demand to leverage bitcoin using DeFi if it’s easily accessible and cheap to create and redeem. I believe that crypto custodians are best primed to provide the centralized version of this since the funds are locked up by their customer anyways. Many large investors are required to custody their funds with a qualified custodian so self-custody is not an option for some. It could be another source of revenue for the custodian to give the option to represent the custodied assets as a token and allow people to trade it. Wrapped Bitcoin (WBTC) already exists but charges high fees which has been a barrier to larger adoption. I think with more competition and users that these fees will come down similar to how crypto custodian rates have come down significantly with more competition and larger AUM. For example, Coinbase Custody launched in July 2018 charging 10 bps per month and as of August 2019 charges 50 bps annualized, which I believe will come down even further over time. Eventually there will also be popular decentralized versions for tokenized assets that will co-exist with centralized versions.

Currently the vast majority of people that are using DeFi are crypto native users. However, it’s possible that traditional investors will start using DeFi or a system that looks similar to DeFi in the future. Right now there is the concept of stablecoins like USDC being loaned out and borrowed on DeFi platforms. I could imagine one day that there would be assets of many different kinds represented as tokens such as stocks, real estate, bonds, etc that traditional investors could use as collateral to gain leverage and/or take out a loan. However, I believe that these systems will be highly regulated since traditional investors wouldn’t use it otherwise. It’ll likely look like a form of DeFi as we have now that is more efficient and cheaper than the traditional system but with more regulation than DeFi.

Risks

While DeFi is fascinating, it is important to acknowledge the risks that come with it. There is significant smart contract risk as these systems are new and some have only been operating for a few months. When many of these protocols are interacting and building on top of each other, the smart contract risk gets compounded. If this risk did not exist, then it would be obvious to lend out a significant amount on DeFi protocols right now (although note that if more people try to take advantage of the high interest rates then the current interest rates could come down significantly).

There is also the risk of collateral type used to back the loan. Even overcollateralization can’t account for the volatility of some of the assets if the price falls so quickly that margin calls still don’t cover the full amount that was borrowed. Right now with a reasonable overcollateralization ratio and accepted collateral type on some platforms, potential loan defaults haven’t been as concerning as the smart contract risk.

I also believe that there will be more regulation in the DeFi space as the volume becomes larger such as requiring KYC which could reduce liquidity for some projects and make it more difficult for people without the proper documentation to access. This will differ based on different factors such as the product type, jurisdiction, and level of decentralization (while people use the term “DeFi” many of the projects aren’t very decentralized in its current stage).

Given these risks, there is discussion around using decentralized insurance to hedge some of the risk. You can do this with prediction markets like Augur (e.g. defisurance) by betting that there will be a smart contract issue on one of the protocols and getting paid out if there is. There are also decentralized insurance projects (e.g. Nexus Mutual) that have started up with their own system for handling payouts. However, it is important to note that these methods also compound smart contract risk and add their own separate areas that require due diligence such as governance structure, risk assessment, claims process, etc. If the DeFi space gets large enough then traditional insurance companies might offer products as well.

Another potential issue is that the interest rates are volatile on many DeFi platforms that it could be impractical for someone to know if they should borrow or use their capital for lending out on DeFi. There will likely be interest rate swaps created in the future to lock in a rate for a premium but this also adds its own complexities.

Conclusion

Overall it’s important to understand that we are very much in the early days of DeFi but the potential is massive. Not only will more people who are excluded from traditional financial systems be able to have access to financial products, we will see new finance products being created that we have never seen before. Criticizing DeFi as a category doesn’t make sense to me as a lot of the complaints are a result of how early the space is. We can see there is clear traction from developers and users. More specific feedback towards individual projects is always helpful and would be more productive.

Thanks Jordan Palmer for reviewing this post.

Disclaimer: Linda Xie is a Managing Director of Scalar Capital Management, LLC, an investment manager focused on cryptoassets and is a personal investor in dYdX.